A New Way to Think About Property Insurance

When researching the best insurance policy for your home or business, what is the first thing that comes to mind? Cost, most likely. Purchasing an insurance policy today can be as simple as a filling out a few questions on a website and clicking a 'submit' button. The danger in this ease of access and application is that the policy is soon forgotten about; that is, until a disaster strikes.

When researching the best insurance policy for your home or business, what is the first thing that comes to mind? Cost, most likely. Purchasing an insurance policy today can be as simple as a filling out a few questions on a website and clicking a 'submit' button. The danger in this ease of access and application is that the policy is soon forgotten about; that is, until a disaster strikes.

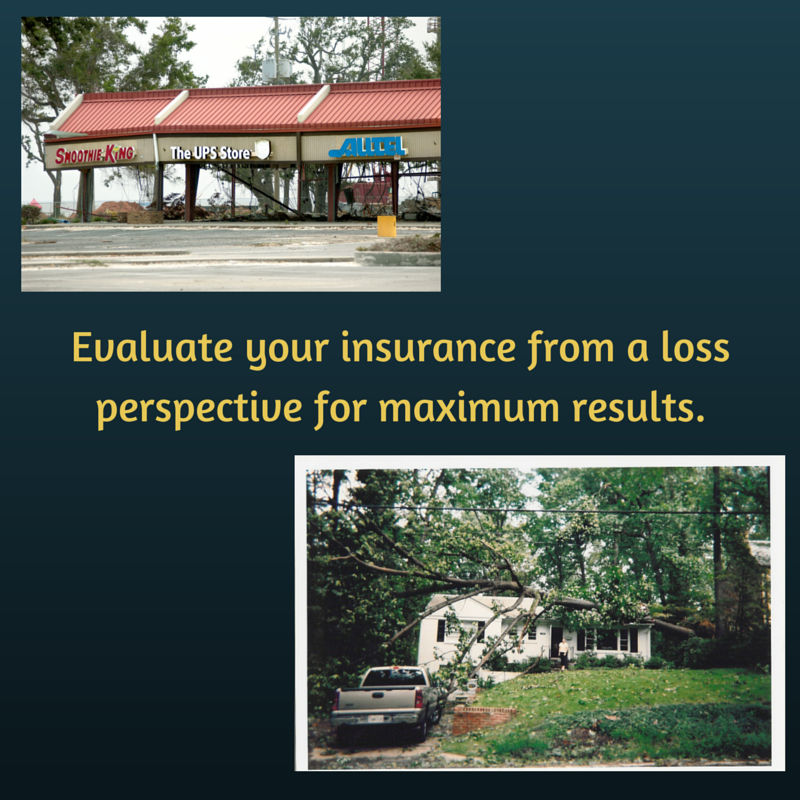

The best way to think about property insurance is not based on premium or price, but rather by conducting a risk assessment, or viewing it from a loss perspective. Use the following questions to create a detailed evaluation of your policy to determine whether it fits all your needs:

What does the policy cover?

In the insurance world, there is no one-size-fits-all policy. Every house, business, and building has different needs in regards to coverage. If you live on the coastline where there are frequent hurricanes, you will have different insurance coverage needs than someone who lives in ‘tornado alley.’

Does it account for your geographical risks’?

- Researching the weather patterns your building will be exposed to is a good place to start to figure out what additional coverages you will need in your policy. Some weather events that may involve needing extra coverage would include:

- Earthquakes

- Flooding

- Hurricanes

- Windstorms

- And more

Does it account for your special circumstances?

- Whether you are a home or a business owner – your family, employees, and job all have special circumstances that directly influence the amount of coverage you will need to carry. Some of these unique situations may include accounting for the following if a disaster should strike:

- Accounts receivable/payable

- Antiques/Collectibles

- Customer service in the interim

- Distributors/suppliers

- Furniture

- Lawn care/vegetation

- Marketing to customers

- Records

- Payroll

- Personal property

- Temporary living location/hotel expenses

- Valuables

- And more

What gaps exist in the policy?

Unbeknownst to many, standard property insurance policies have many exclusions. Even more surprising is that the excluded events are actually very common occurences for property owners, such as flooding.

Weigh your coverage options and understand what gaps exist in your policy. You can then decide whether to purchase additional coverage or prepare your property for when the risk is higher for these events to occur in an attempt to mitigate the damages.

Are you purchasing for quality or cost?

A low monthly payment may be beneficial to your short-term goals but once a disaster strikes you are going to wish you had the right amount of coverage on your home or business. Not having enough insurance can cost you a hefty portion of your settlement in certain cases. Here are some problems or penalties you may run into by not having enough insurance coverage:

- Builder’s Risk Insurance

- Business Income Insurance

- Construction Coverage

- Cosmetic Damage

- Coinsurance

- Debris Removal

- Equipment Breakdown Insurance

- Ordinance or Law Coverage

- Pollution Damage

- Salvage

- Soft Cost/Delay in Opening

- Valuable Papers and Records

Don’t purchase your insurance based on a monetary value; make smart purchasing decisions by weighing out the pros and cons of including or excluding certain coverages depending on your special circumstances. Evaluate your coverage from a loss perspective.

For more real life examples of people who suffered property damage and hardships they encountered with their claims, read our case studies: